OUTLOOK REPORT

By Kathie Canning, editor-in-chief

“Consumers are also becoming more educated on the additional health benefits that some of these beverages contain,” she says. “Cold-brew RTD beverages are on the rise in the market and are typically seen as a premium product.”

In line with the trend toward more healthful formulations is a new line of premium functional cold-brew shots from Humblemaker Coffee Co., Seal Beach, Calif. The line, released under the Humblemaker Coffee Co. of California brand, includes three varieties. Boomtowne is a triple-strength black cold-brew shot with a liquid multivitamin supplement to help improve immune system function, energy and overall health. La Fonda is an antioxidant-rich Mexican coffee cold-brew shot with pure cinnamon and cacao that harnesses the immune-boosting power of green tea. And Black Sea is a Turkish coffee cold-brew shot brewed with cardamom and clove and packed with l-theanine and ginseng.

Pursue Happiness made its debut in the RTD coffee space with cold-brew Pursue Happiness Cowffee, which is said to be “a perfect blend of high-CLA whole milk and cold-brew coffee.”

Cold brew boasts appeal

Consumers also are more health-conscious these days, so they are opting for RTD coffee in lieu of high-sugar and carbonated beverages more often, says Lindsay Frye, brand manager for Pursue Happiness, Union Springs, N.Y.

The ready-to-drink (RTD) coffee and tea segment is decidedly no longer a niche market within the United States. The segment racked up retail sales of almost $7 billion during the 52 weeks ending Aug. 9, 2020, according to data from Chicago-based market research firm IRI (total U.S. — multi-outlet with c-store: grocery, drug, mass market, convenience, military and select club and dollar retailers).

A number of trends are driving growth on both the coffee and tea sides. Dairy processors that tap into these trends could grab their share of this lucrative market.

Think outside single-serve

Within the RTD coffee space, the increased incidence of consumers working at home as a result of the COVID-19 pandemic spells opportunity, according to “Coffee and RTD Coffee, Incl. Impact of COVID-19 —US” a July 2020 report from global market research firm Mintel. Specifically, opportunity can be found in multi-serve and multi-unit packaging.

“Multi-serve RTD coffees have a low consumption frequency, indicating an important whitespace opportunity within the wider coffee market,” Mintel states in the report.

Todd Carmichael, CEO and co-founder of Philadelphia-based La Colombe Coffee Roasters, agrees.

“We are seeing an interesting increase in the purchases of multipacks and multi-serve,” he says.

That is a trend that SToK Cold Brew, part of White Plains, N.Y.- and Broomfield, Colo.-based Danone North America, already tapped.

“SToK Cold Brew also offers single-serve options, but we think it’s important to underscore that RTD beverages aren’t just for a single consumption moment anymore, says Brittney Polka, marketing director for the brand, who adds that consumers are “getting creative” with such offerings. “Consumers can have a bottle of SToK in their fridge for the week and enjoy it differently each day.”

Partner it with dairy

Coffee-and-dairy RTD offerings continue to be popular, too — and many of them fit in with the better-for-you trend. Frye notes that her company recently made its debut in the RTD coffee space with cold-brew Pursue Happiness Cowffee, which she calls “a perfect blend of high-CLA [conjugated linoleic acid] whole milk and cold-brew coffee.” The non-GMO, “lactose-friendly” product also boasts 20 grams of protein, is low in added sugar and remains shelf-stable for six months in its recyclable packaging. What’s more, its CLA level is two to three times that of regular milk.

“This is naturally occurring, and CLA has quantifiable [positive] effects on heart disease [and] obesity and is even rumored to be anti-cancer,” she says.

The coffee-plus-dairy aspect of Cowffee also meshes with another trend — one that has been present from the start. Within brick-and-mortar coffee outlets, consumers have always gravitated toward “texturized drinks” such as lattes and cappuccinos, explains Carmichael.

“This has carried over to the RTD space,” he says, adding that his company continues to see growth in its La Colombe Coffee frothy draft latte line. And the company continues to work on “improving the quality, the authenticity and variety of flavors” in the line — and to better showcase the clean taste of its dairy component.

“Simply put, dairy and coffee have — and will — always go together well,” Carmichael adds. “In the RTD space, dairy remains king. We do see an introduction of plant-based milk; nevertheless, dairy remains the primary go-to for the consumer, with very strong growth.”

Frye agrees, and notes that processors are “aggressively looking to raise the bar” to get a leg up on their competition. She sees strong demand for both local dairy products and products that present a unique benefit — for example, non-GMO status or a high protein content.

“There are many new trends on the rise, but one that’s a little less common is ‘creamline’ processing,” she says. “This is where the milk is processed differently, and more naturally, enabling the cream to float to the top, earning its name.”

Products with less sugar also mesh with the trend toward more healthful products within the RTD latte space. This past fall, Neenah, Wis.-based Horseshoe Beverage Co. introduced RTD Black Stag lattes with 40% less sugar. Made with premium 100% Arabica coffee and quality ingredients, the Black Stag lattes come in Mocha, Vanilla, Caramel and Original flavors.

In spite of the popularity of RTD coffee/dairy blends and flavored RTD coffee, black RTD coffee remains a consumer go-to as well. In fact, 2020 marked the first time consumers spent more money on black RTD coffee than on creamed RTD coffee, Polka points out, citing 52-week data (ending Sept. 27, 2020) from IRI.

“SToK has a variety of un-sweet cold-brew roasts to match those preferences,” she says.

The latest of those to roll out on store shelves is SToK Bright & Mellow. The RTD cold-brew offering is a lighter roast, Polka explains, resulting in a complex flavor.

“The Arabica beans mellow out and open up for an intriguing cold brew with citrus and stone fruit notes that’s surprisingly refreshing,” she says.

Still room for indulgence — and more

Despite the interest in more healthful formulations, indulgent offerings are also on-trend, Polka says.

“In fall 2020, SToK launched its Pumpkin cold brew — our take on shaking up the traditional ‘pumpkin season’ with a bold, flavorful seasonal brew,” she notes. “Both retailers and consumers responded well, and we’re taking that feedback to heart as we look to innovation in 2021.”

Danone North America’s International Delight brand skewed indulgent, too, in its most recent RTD iced coffee introductions. The brand debuted an Oreo flavor in April 2020, Polka says, and followed up with a Chocolate Caramel flavor in September 2020.

Horseshoe Beverage Co. introduced RTD Black Stag lattes with 40% less sugar.

“The need for flavorful beverages with functional ingredients has never been higher, especially since people are looking for ways to improve their health without having to think about it,” he says. “Our [Teakoe] Fizzy Tea is in a unique position because it can bring just as much flavor as soda without the added sugar, as well as provide way more substance than sparkling water while maintaining a low-calorie content.”

Also meshing with the better-for-you trend is the use of all-natural and unprocessed sweeteners such as honey in RTD tea, notes Catherine Barry, director of marketing for the National Honey Board, Frederick, Colo.

“Honey has been an all-natural sweetener used in teas for hundreds of years, and it’s having its own resurgence, thanks to its flavor, functionality and marketability in the RTD tea category,” she says.

Barry adds that in addition to RTD tea with functional benefits, kombucha, sparkling tea and refrigerated tea currently are in vogue.

New on the kombucha side is Live Seltzer from Kombucha Town, Bellingham, Wash. The product is said to be a hybrid between two of the fastest-growing and most popular categories in the beverage industry over the last 20 years: functional beverages and seltzers.

According to Kombucha Town, Live Seltzer is a proprietary blend of the company’s organic and non-GMO raw kombucha cultures, fresh-pressed “hero” ingredients and carbonated water from the North Cascade mountains. The seltzer beverage comes with zero sugar, 1 to 2 calories per serving and the benefits of kombucha.

And within the shelf-stable sparkling RTD tea space, Columbus, Ohio-based Spritz Tea recently unveiled a new look and two new single-serve flavors — Bright Citrus and Wild Acai. The previously existing flavors in the brand’s “softly sparkling, boldly flavored” tea infusions portfolio were renamed, and the flavors were slighted tweaked, too. Previously marketed as Hibiscus and Green, the two flavors are now Pink Guava and Golden Peach, respectively, the company says.

SToK Bright & Mellow is an RTD cold-brew offering based on a lighter roast, resulting in a complex flavor.

Go multi-serve, functional with tea

The RTD tea category, meanwhile, isn’t reaping the same benefits as RTD coffee is from consumers’ work-at-home scenarios. In fact, there’s a trend toward less-impulsive consumption, Mintel reports in its August 2020 “Tea and RTD Tea: Incl. Impact of COVID-19, US” report.

“In this market, tea brands can optimize performance by adapting to shrinking impulse-driven beverage purchase occasions through packaging changes or, more likely, promotions that adjust to new consumer routines,” Mintel states in the report. “The increased incidence of consumers working from home represents an opportunity for RTD teas to promote their multi-serve and multi-unit packaging.”

But the COVID-19 pandemic also has changed consumer behavior in ways that stand to benefit the entire tea category, Mintel notes. For example, health concerns have consumers clamoring for better-for-you offerings, and tea fits the bill.

“Health concerns and the potential for tea to relieve or stave off sickness will allow it to retain most of the gains [made in 2020] by increasing purchase among regular users and trial among those willing to consider it,” Mintel says.

Pete Jokisch, founder and president of Teakoe Tea Supply Co., Denver, points to high interest in convenient, tasty beverages with functional ingredients — and RTD tea fits in here.

Prepare for challenges

Despite trends that bode well for both the RTD coffee and RTD segments, processors face some challenges that could threaten growth.

One such challenge is “finding ways to make dairy shelf-stable in more applications” while keeping the desired texture and taste, Carmichael says.

“We are looking at the next wave of shelf-stability coming from greater availability in aseptic technologies,” he says.

Consumer misconceptions related to dairy products and dairy farming also are issues in the RTD coffee-plus-dairy space, Frye maintains. False claims tied to cows and global warming, for example, are a concern.

“The education is lacking, and people have lost sight of why dairy is so important to the human body and all the nutrients they gain from it,” she says.

But another “challenge” is a positive for the RTD coffee segment: The category is growing fast, especially on the multi-serve side, Polka says.

“RTD coffee is the fastest-growing category [in] the dairy aisle,” she points out. “With more home consumption, we’re working diligently with our cross-functional team in supply/demand, trade and marketing to keep up with consumer demand while also ensuring our innovative spirit remains.”

With strong competition in the RTD tea space, standing out can be a challenge, Barry notes.

“Great taste and attractive packaging are a starter, but you also need an ingredient listing that meets consumer demands for more clean-label products. Honey is an ingredient that fits demands for flavor, marketing and clean-label teas.”

Another challenge on the RTD tea side is the reality that many tea brands rely on third-party copackers to create “generic tea products,” Jokisch maintains. The products typically are made with tea extracts or concentrates, and the brands lack flexibility when it comes to innovation or varying scale.

“The use of misleading terms such as ‘lightly brewed’ or ‘real brewed’ makes it challenging for producers to differentiate their process of actually brewing tea properly and then communicating that effectively to the end consumer,” he says. “The opportunity exists, however, with people wanting to know more about the products they consume and brands providing more transparency to their process.

Teakoe Fizzy Tea is said to deliver just as much flavor as soda without the added sugar.

Capture all channels, occasions

Jokisch adds that an omni-channel approach — encompassing strategic partnerships across the retail, foodservice and online channels — is important in the RTD tea segment because consumers “want access to these products at any point during the day.”

For its part, the company will be introducing RTD tea products that aim to fill daily-routine-related gaps among products currently available under the Teakoe brand, he says. Planned additions include caffeine-free and functional formulations.

“Additionally, we’ll be introducing a four-pack case at the retail level to allow larger purchases of our product at a more cost-effective price point, Jokisch says. “Lastly, improvements within our direct-to-consumer model will enable us to expand this channel and engage more closely with our supporters.”

Note: This sidebar was condensed from an article written by Barbara Harfmann that first appeared in the January issue of Beverage Industry, a sister publication of Dairy Foods.

“Good Belly has been a standout brand within nectars and demonstrates the potential for juices which promote gut health,” the report states. “Long-declining juice drinks saw growth in value sales in 2019, thanks to the notable performance of the Bai brand.”

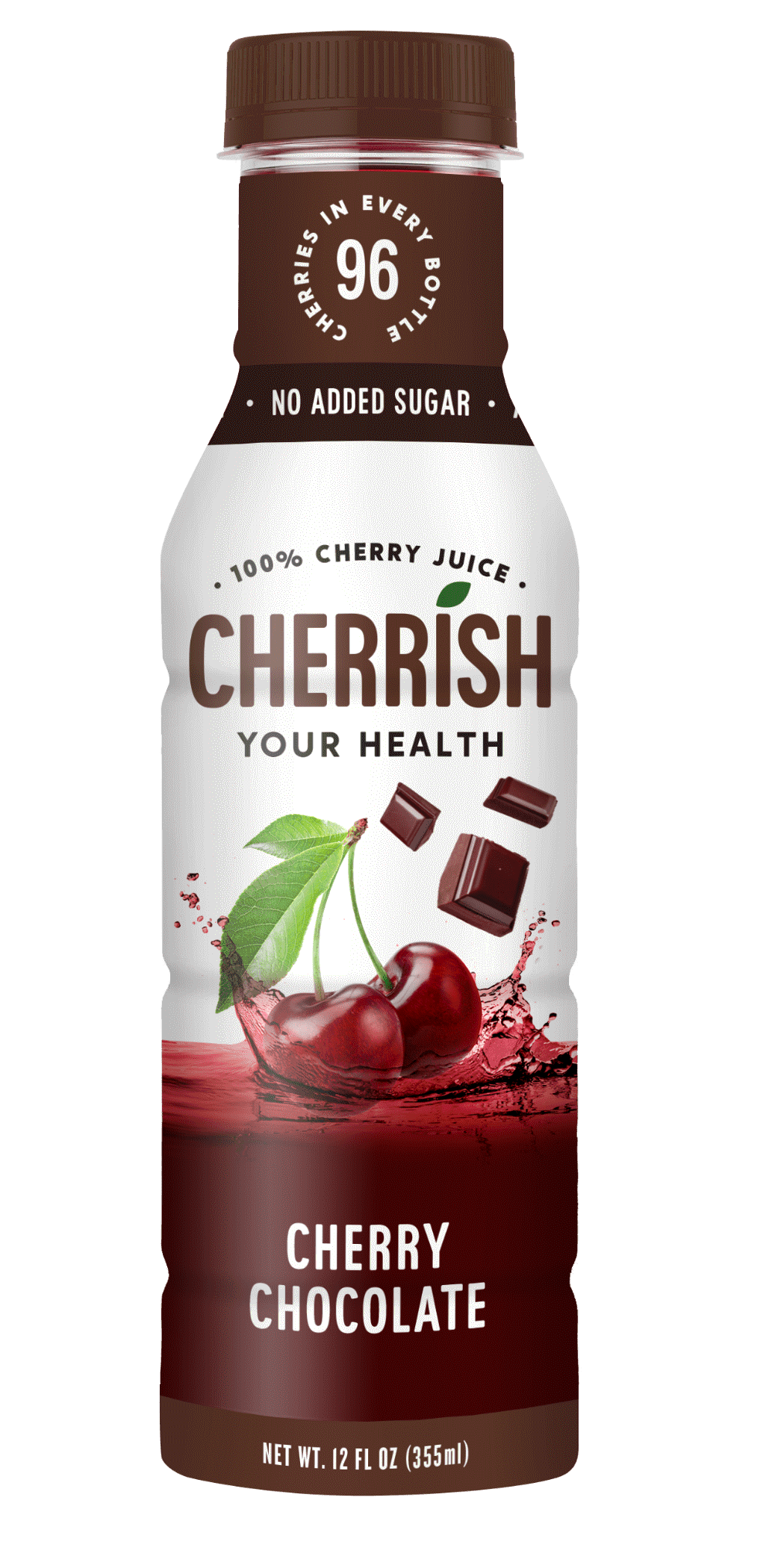

Capitalizing on consumers seeking no- or low-sugar juice options, CHERRiSH, Bellevue, Wash., recently released a new flavor, Cherry Chocolate, to its low-glycemic, non-GMO, no-sugar-added lineup. The variety, along with Cherry Original, Cherry Pomegranate and Cherry Blueberry, harnesses the power of U.S.-grown Montmorency tart and sweet Bing cherries, and offers high levels of antioxidants and anti-inflammatory and sleep-benefiting properties, the company says.

The importance of a healthy immune system is top of mind for most consumers, too, renewing interest in a familiar functional ingredient: vitamin C, according to “Juice and Juice Drink: Incl. Impact of COVID-19 — US,” a June 2020 report from global market research firm Mintel.

“As a result, demand for orange/citrus juice has skyrocketed, driving the category’s unprecedented growth. Industry giants (e.g., Tropicana, Minute Maid) and lesser-known brands (e.g., Uncle Matt’s Organics, Natalie’s Orchid Island) have both seen increased year-over-year sales,” the report states. “Consumers’ standing investment in wellness will make immunity claims a priority in the longer term. However, brands will need to address the pre-pandemic concerns that plagued the juice category (e.g., high sugar content, limited functional benefits) to maintain growth once hype surrounding the virus subsides.”

To compete with the growing list of niche better-for-you beverages such as still and sparkling waters and nutritional drinks, juice brands will need to deliver on consumers’ definition of “healthy” in 2021, including the addition of premium added-value claims.

“We believe once the impact of the pandemic has subsided, sales are likely to be softer, and the category may see declines once again,” says Gary Hemphill, managing director of New York-based Beverage Marketing Corp.

CHERRiSH recently released a new flavor, Cherry Chocolate, to its low-glycemic, non-GMO, no-sugar-added juice lineup.

Juice rebounds

In recent years, the high sugar content of juice and juice drinks and the beverages’ association with breakfast time saw the category floundering. However, the COVID-19 pandemic has led consumers to seek out healthful, immune-supporting benefits, leading, in turn, to a resurgence in juice and juice drinks.

The refrigerated juices and drinks category saw dollar sales jump 11.8% to $7.1 billion during the 52 weeks ending Nov. 1, 2020, according to data from Chicago-based market research firm IRI (total U.S. — multi-outlet with c-store: grocery, drug, mass market, convenience, military and select club and dollar retailers). The largest segment within that category, orange juice, saw dollar sales rise 15.5% to $3.2 billion.

Experts note that the pandemic has sparked a demand for ingredients that promote immunity and digestive health.

In its December 2019 “Juice in the US” report, Chicago-based Euromonitor International states that unlike other health trends, interest in digestive health has consistently grown, as evidenced by increased sales of brands that offer added probiotics.