By Nate Donnay

GLOBAL INSIGHTS

Higher feed costs will ripple through dairy markets

The elevated feed costs raise the floor for dairy prices.

With all 10,000 of our lakes here in Minnesota currently frozen solid, this may be a strange analogy, but dairy prices move like the waves rippling out from a rock thrown in the water. The bigger the rock, the bigger the initial waves are, but they eventually get smaller and smaller until everything is back into balance. It takes only seconds for the waves to flatten out on the lake, but it can take one to two years for the dairy markets to find equilibrium after a large shock.

I bet you think I’m going to talk about the pandemic, but I’m not. Another shock to the dairy market will be playing out into early 2022 and deserves some attention.

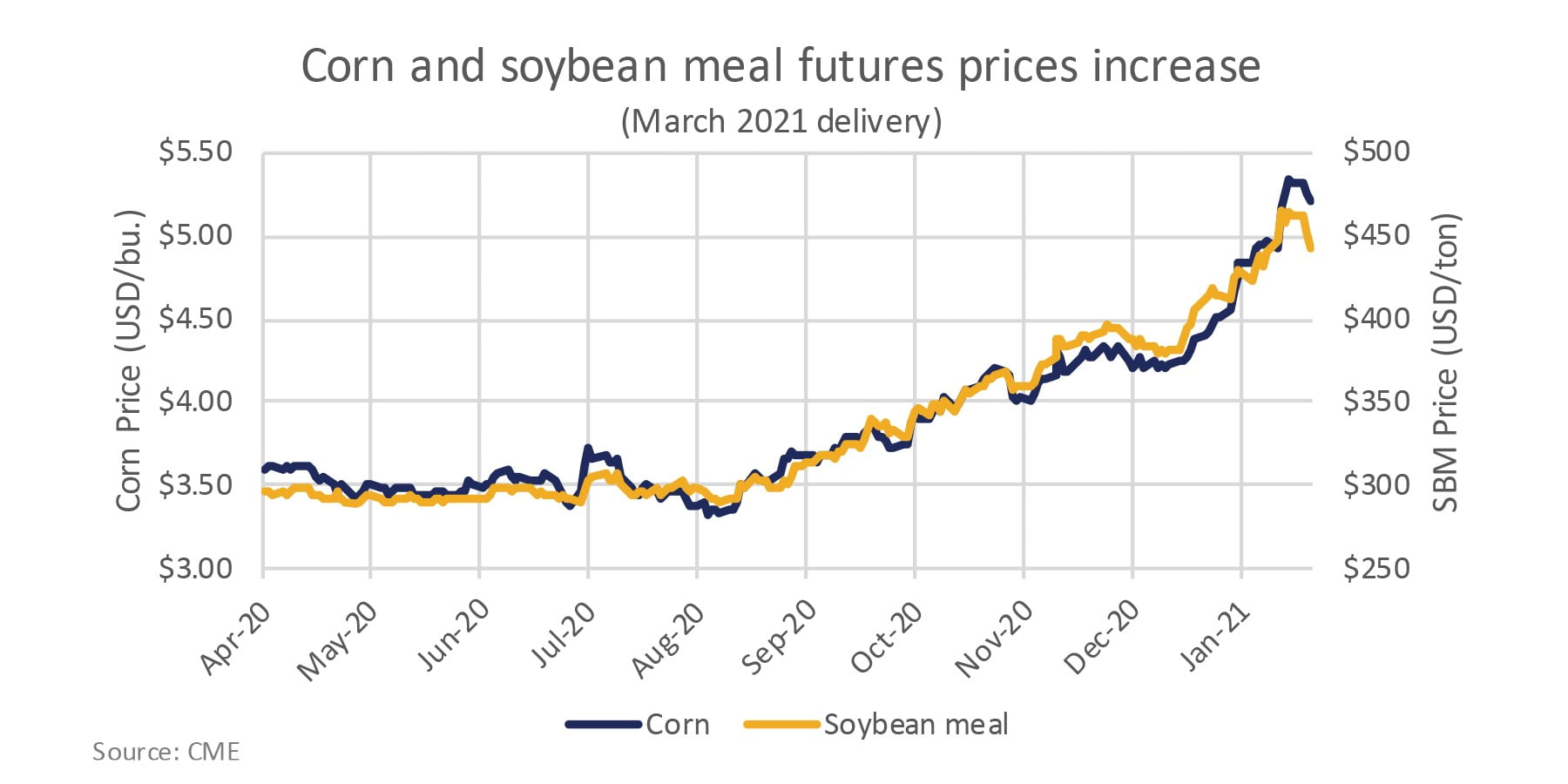

Feed costs have shifted dramatically higher in the past six months. There wasn’t a large driving event that tightened feed supplies, but rather it has been a number of smaller issues all coming together at the same time. U.S. corn and soybean yields weren’t horrible, but they were below trend. Crops in parts of Europe and the Black Sea region also suffered some adverse weather this season.

On top of the generally weak production, demand has turned out stronger than expected, particularly from China. The net impact is that expected carryout stocks of grain and oilseeds have been trending down for the past seven months, and feed prices have consequently been trending higher.

Back in May, the corn and soybean meal futures were suggesting that the cost of feed to produce 100 pounds of milk in 2021 would be around $6.19, but with the rally, futures are now suggesting a price closer to $7.34. That means the cost of production for dairy farmers is up more than a dollar per hundredweight in the past seven months. That is nearly a 19% increase. In terms of individual dairy products, it adds about 12 cents per pound to the cost of cheese or 25 cents per pound to butter.

Nate Donnay is the director of dairy market insight at StoneX Financial Inc. and has been applying his interest in large, complicated systems and statistical analysis to the international and U.S. dairy markets since 2005.

Government purchasing holds steady

The stone-in-the-lake analogy doesn’t exactly fit the current feed cost situation, though. Thanks to government purchasing programs, cheese prices hit record highs in the second half of 2020, and my expectation is that government purchases can probably keep cheese prices generally strong in the first half of 2021.

The resulting milk prices should be high enough to keep farm gate margins at breakeven or slightly higher levels for U.S. dairy farmers despite the higher feed costs. The higher costs still impact the production and price outlook, but instead of pushing dairy prices higher, the elevated feed costs raise the floor for dairy prices.

I don’t want to get overly optimistic on prices here. The pandemic is still depressing U.S. dairy demand. Government purchases are absorbing the currently expanding milk production. If milk production growth continues to run at 2.5% or more, it will be hard for the government to absorb all of it.

Dairy prices will still be volatile as they bounce between the underlying bearish fundamentals and the bullish government purchases. But the increased feed costs mean that breakeven for dairy farmers is now somewhere around $16.00 for Class III milk or $1.70 for cheese.