Milk sales swirl like fall winds

Cheese, butter “rockin’ out” with record exports

By Nate Donnay, Director of Dairy Insight, StoneX Financial Inc.

U.S. cheese exports at a “record” 14%, with butter at a 10-year high.

In “Born to Run,” the title track off the iconic record of the same name that gave Bruce Springsteen international fame, the Boss’ signature line, “Tramps like us, baby, we were born to run!” conjures an image of the rebel with the wind at their back, the promise of freedom on the horizon.

In the case of U.S. dairy exports, no “rebelling” is needed, particularly since price is powerful. For all the concern about trade wars, slowing global economic growth, shipping issues and de-globalization, U.S. dairy exports have been strong for products where U.S. prices have been relatively cheap over the past year. In fact, cheese exports have been at a record high while butter and AMF exports are at 10-year highs (and still trending higher).

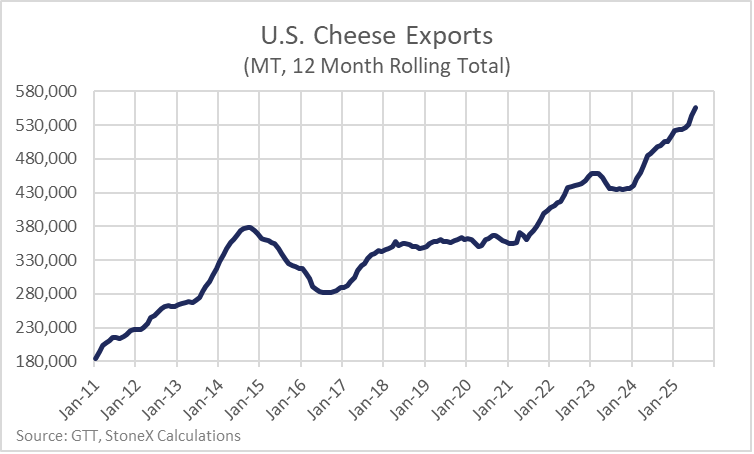

There is a long-term uptrend for U.S. cheese exports as U.S. production increases and U.S. cheese makers continue to tailor their products for the export market, so we can’t attribute all of the growth in cheese exports to price, but year-to-date (YTD) exports are up 14.1% from last year hitting new record highs on top of the record high levels from last year.

Cheese exports, out of the other major exporters, were strong early in the year, but they slowed during the second quarter and into the third quarter as the U.S. took market share. Over the past 12 months the CME block Cheddar price has averaged $1.85 per pound while European Cheddar has been $2.34 and New Zealand Cheddar on GDT has been $2.20.

The U.S. has had a clear price advantage that has helped to move cheese into the export market. The buying has been wide based with cheese exports over the past 12 months up to 9 of our top 10 destinations which include Mexico, South Korea, Japan and Australia.

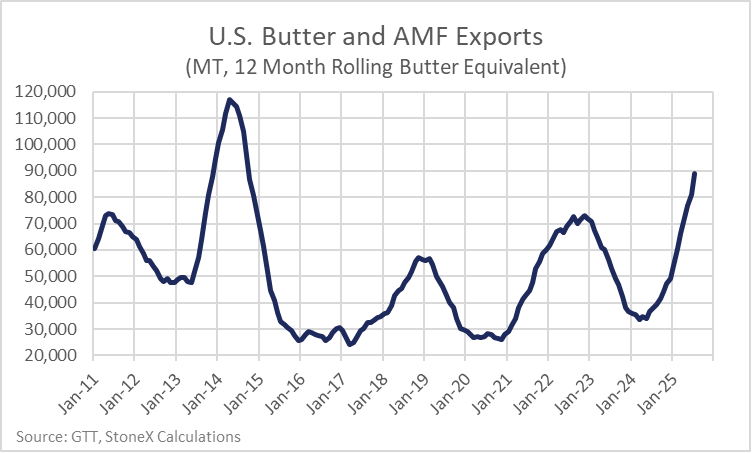

U.S. butter and AMF exports aren’t at a record high, but they have been quite strong and up 132.6% over the past 12 months. Butter is often a “residual” product in the U.S. Very strong milk production has resulted in a surge of butter production during 2025, which has helped to keep U.S. prices cheap relative to the world market. Over the past 12 months, the CME spot butter price has averaged $2.51 per pound while Europe was more than a dollar higher at $3.65 and New Zealand was $3.27. The price spread has been so wide that the U.S. has been able to export product into Europe despite tariff rates that range from about 50 cents to a dollar a pound. Canada remains the largest buyer of U.S. butter while we’ve seen significantly more product going to South Korea, Saudi Arabia, Europe and Australia in the past 12 months.

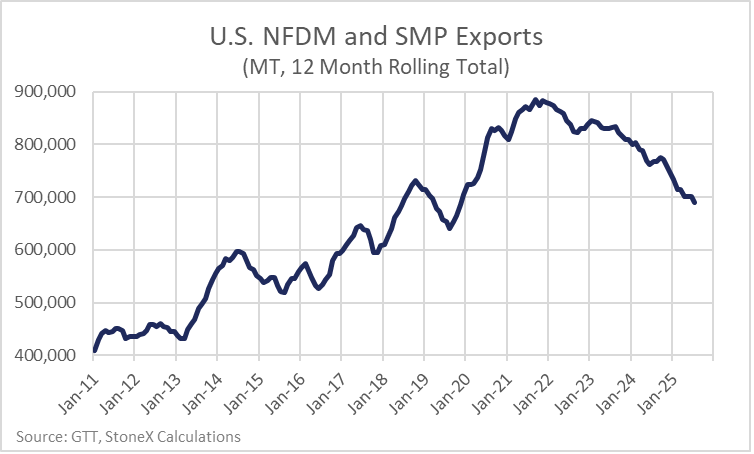

Exports of dairy products that the U.S. has not had a big price advantage in have been less bright than cheese and butter. The CME spot NFDM price has averaged $1.29 per pound over the past twelve months while European SMP has averaged $1.21 and New Zealand SMP averaged $1.29. So, Europe has been cheaper than the U.S. and we’ve been about flat against New Zealand. U.S. exports of NFDM+SMP have dropped 10.2% over the past 12 months and are down 17.2% from two years ago. Part of the decline is driven by less production of NFDM and SMP in the U.S. Skim milk has shifted into MPC and casein production and away from the lower protein milk powders. And on top of the shift in product mix in the U.S. global demand for skim powders has been trending down as well.

Arguably, exports have been good overall, and the trade war issues have had less of an impact than many expected this year. U.S. cheese and butter prices have been cheap enough, and availability high enough, to push exports significantly higher. We have seen global prices for cheese and butter decline rapidly during August and September with European cheese prices closing much of the gap to the U.S. That could flatten out U.S. cheese exports as we get into 2026. The price of butter in the U.S. has fallen at about the same rate as European butter prices have, so the U.S. is still very cheap globally and should support good exports out into early 2026 but there will likely be more competition globally than what we saw in 2025 which could dent U.S. fat exports in the second half of 2026. I think we’ll see a small increase for NFDM+SMP exports in 2026, but for that to happen we need to see global demand start to trend higher and break the two-year downtrend it has been on. DF

Source: Circana, a Chicago-based market research firm (@circana), for the 52 weeks ending Sept. 7, 2025. Total U.S. multi-outlet with c-store (supermarkets, drugstores, mass market retailers, gas/c-stores, military commissaries and select club and dollar retail chains). Note: Sales rankings shown are for total brand listings.

Opening image courtesy of halbergman / E+ / Getty Images.